News

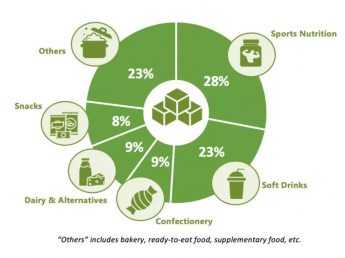

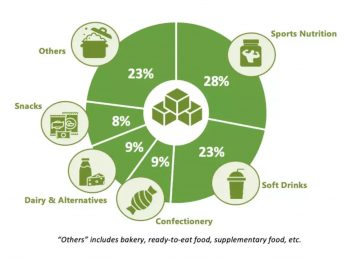

The excessive consumption of sugar has caused widespread concern. In September 2021, Academician Chen Junshi pointed out at the "First China Drinks Healthy Consumption Forum" that replacing sugar with sweeteners is the development trend of the beverage industry. So, what are the current sugar replacement programs? Which sweetener is more promising? Chen Junshi - Member of China Engineering Academy General Counsel, National Center for Food Safety Risk Assessment Low sugar, sugar replacement trend Sugar is one of the most popular ingredients in the diet. Consumers are accustomed to the sweetness and texture, and enjoy the comfort and happiness from it. However, it is surprising that most sugar consumption comes from deep-processed foods and sugar-sweetened beverages, rather than desserts and candies. At present, global consumers' attitudes towards sugar have changed: processed sugar is considered unhealthy, which has led to an increase in obesity rates around the world, while less refined sugar is considered clean and natural. Global concerns about excessive sugar consumption and the increase in diseases have led to an increase in demand for low-sugar and low-sugar products. This situation has forced food and beverage formulators to put sugar reduction in the first place in product innovation, development, and marketing strategies. Similarly, sweetener manufacturers are also more in-depth research and development of sweeteners to replace sugar to cater to this highly active market demand. Classification and key characteristics of sweeteners The global sugar and sweetener market share are approximately US$25 billion (approximately RMB 161.1 billion), and this market has undergone tremendous changes in the past decade. More research and development are underway, including low-sugar, low-calorie sugar, high-sweetness sugar, artificial sugar, processed sugar, and natural sugar selection. Generally speaking, sweeteners can be divided into the following six categories: (1) Sugars: carbohydrates are naturally present in many foods, including fruits, vegetables, grains, and milk. The most common are sucrose, glucose, fructose, lactose, maltose, galactose and trehalose. (2) Sugar Alcohols: A type of carbohydrates naturally found in plants and grains, albeit in small quantities. The human body cannot completely metabolize them, so they tend to have fewer calories per gram of weight. The most common are sorbitol, xylitol, mannitol, maltitol, erythritol, isomalt, lactitol, and glycerin. (3) Natural Caloric Sweeteners: The oldest known sweeteners, including honey and maple syrup. They not only contain sugar, but also other nutrients. Their glycemic index is often lower than sugar. The most common ones are honey, maple syrup, coconut palm sugar, and sorghum syrup. (4) Natural Zero-Calorie Sweeteners: They are not carbohydrates, they only contain few or no calories. In recent years, people's interest in this type of sweetener has increased day by day because they are good substitutes for artificial sweeteners. Their glycemic index is zero and they have an aftertaste. The common ones are stevia, allulose, mogroside, and brazzein. (5) Modified Sugars: These sugars are usually produced by enzymatic conversion of starch, including modified sugars such as caramel or golden syrup. They are often used in cooking or processed foods. The most common are high fructose corn syrup, caramel, agave syrup, inverted sugar, and golden syrup. (6) Artificial Sweeteners: Artificial sweeteners are usually called "high-intensity sweeteners" because their taste is similar to sugar, but their sweetness is as high as several thousand times. There are many types on the market, and some seem to be safer than others. They have been used in the United States and Europe for more than 120 years. The most common ones are aspartame, sucralose, saccharin, neotame, acesulfame K and cyclamate. The key characteristics of sugar and sweeteners include sweetness (relative to sucrose), calorific value (calories per gram), taste, texture, volume, color (browning) and probiotic functions. Sugars, modified sugars and sugar alcohols are usually products with lower sweetness and standard calorific value (2~4 cal/g), while artificial sweeteners are products with higher sweetness and usually no calories. Most of the research and development centered on sweeteners with high sweetness and low calories. Clean, pure and natural has become the driving force for the development of these sugars. However, price is still the biggest driving force for development and innovation in the sweetener and sugar fields. The challenge and the key to development Since 2018, the market for high-intensity sweeteners has begun to grow, with a year-on-year growth of 12% in 2019. Although people are worried about the metallic odor and slightly bitter aftertaste brought by high-intensity sweeteners, high-intensity sweeteners are used in all major food categories, such as nutrition, baking, beverages, and candy. Sweetener suppliers are under great pressure to provide the right solutions. Many suppliers have introduced new solutions that combine high-intensity sweeteners, rare sweeteners and low-intensity sweeteners. Multinational companies are helping their customers experiment with different product formulations through digital platforms to find the right taste and texture. New product development is the key to the sweetener business. Most of the research and development of sweeteners are focused on sweetness, calorific value, taste, odor resolution, key functions and price competitiveness. Before expanding into commercial production, new products, application development, functional features (such as probiotic functions), feasibility, and product price models need to be tested. Generally speaking, it takes 12 to 18 months for a company to develop any new process or new product containing new ingredients. In addition, for a new sweetener product, large-scale commercialization is relatively slow, because the market now has many options and alternatives. With the development of the food industry in the direction of low-calorie, low-sugar, high-fiber, natural, organic, clean and healthy, more and more manufacturers are replacing sugar with sweeteners and natural substitutes without compromising taste. . Sweetener manufacturers are also studying rare sugars, such as fucose, kojibiose, cellobiose, brown sugar, etc., but these are still in the research stage, and the main challenges they face are product feasibility and formulation requirements. Sweetener manufacturers are facing severe pressure to develop new products and need to provide correct solutions for formula makers around requirements such as taste, texture, cleanliness, and price. The natural sweeteners, allulose and stevia, are still untapped areas for many manufacturers, with promising prospects in the next five years.

Arabic gum, also known as acacia gum, is a natural gum sourced from the sap of the Acacia senegal and Acacia seyal trees, found in the dry regions of Africa. This versatile ingredient has been used for centuries in a wide range of industries, including food and beverage, pharmaceutical, and cosmetics. In recent months, the market for Arabic gum has seen some notable trends and developments. According to a recent market report, the global Arabic gum market is projected to grow at a CAGR of 7.8% from 2021 to 2026. The increasing demand for natural ingredients and the growing food and beverage industry are the key factors driving this growth. The report also highlights the significant use of Arabic gum in the pharmaceutical and cosmetics industries, where it is used as a binding agent, emulsifier, and stabilizer. In the food and beverage industry, Arabic gum is used as a thickening agent, stabilizer, and emulsifier in a variety of products, including soft drinks, ice cream, and bakery products. With the rising demand for natural and plant-based ingredients, Arabic gum has become a popular choice among consumers and manufacturers alike. Its ability to improve texture, mouthfeel, and shelf life has made it an essential ingredient in many processed foods. In the pharmaceutical industry, Arabic gum is used as a binder in tablet formulations and as a coating agent for capsules. Its natural properties make it an attractive alternative to synthetic binders and coatings. In addition, it has been found to have potential therapeutic properties, such as anti-inflammatory and antioxidant effects, which make it a valuable ingredient in certain drug formulations. In the cosmetics industry, Arabic gum is used as a thickener and emulsifier in a variety of products, including lotions, creams, and hair care products. Its natural properties make it a popular choice among consumers who are looking for natural and sustainable products. In conclusion, the market for Arabic gum is seeing significant growth due to its versatility and natural properties. With the increasing demand for natural ingredients and plant-based products, Arabic gum is poised to become an essential ingredient in many industries in the coming years.

A natural low-calorie sweetener popular in North America, Japan and South Korea has appeared, its name is allulose-D-allulose. What can it bring you? # Natural # Healthy and Less Restrictive Natural: Allulose is 70% sweeter than sucrose and provides 0.3% calories. Fructose is used as the raw material and is converted by isomerase. So far, it is the closest to the taste of sucrose and has no side effects. Erythritol is derived from microbial fermentation and chemical synthesis, and microbial fermentation is the main method. Generate better Maillard reactions in the baking world! Healthy and with few restrictions! Allulose is closer to sucrose, and the difference from sucrose is almost imperceptible, so there is no need to mask the bad aftertaste by compounding, and it can be used independently. Allulose is almost not metabolized and does not provide calories after being absorbed by the intestinal tract, so it will not cause gastrointestinal discomfort like sugar alcohols. This is what distinguishes allulose from other sugars, and its most prominent advantage as an alternative sweetener. In 2012, 2014 and 2017, the US FDA designated D-psicose as a GRAS food; In 2015, Mexico approved D-psicose as a non-nutritive sweetener for human food; In 2015, Chile approved D-psicose as a human food ingredient; In 2017, Colombia approved D-psicose as a human food ingredient; In 2017, Costa Rica approved D-psicose as a human food ingredient; In 2017, South Korea approved D-psicose as a "processed sugar product"; Singapore approves D-psicose as a human food ingredient in 2017

In recent years, the application of carrageenan as a food additive in food processing has become increasingly widespread. Carrageenan is a high molecular weight compound with properties such as viscosity, gelation, and stability, making it widely used in the food industry. As a natural food additive, carrageenan has been extensively applied in various fields including beverages, dairy products, baked goods, and meat products. Among these, the most popular application area is dairy products, such as cream, cheese, and ice cream. Carrageenan, a high molecular weight compound with properties such as viscosity, gelation, and stability, is widely used in the food industry. Below we will provide a detailed overview of carrageenan's applications in different food sectors. Beverages: Carrageenan is primarily used as a stabilizer and thickener in beverages, enhancing their texture and stability. In fruit juices, carrageenan suspends the juice in the liquid to prevent sedimentation while also increasing the viscosity and mouthfeel of the juice.Dairy Products: One of the most popular application areas for carrageenan is in dairy products. Carrageenan stabilizes cream, preventing the separation of milk fat. In cheese and ice cream, carrageenan increases viscosity and mouthfeel, prevents ice crystal formation, and improves the overall quality of the ice cream.Baked Goods: In baked goods, carrageenan is typically used as a thickener and gelling agent. For example, in pastries, carrageenan increases thickness and elasticity, resulting in a softer product. In bread and cakes, carrageenan increases viscosity, making the dough easier to mix and process.Meat Products: Carrageenan is primarily used as a stabilizer and thickener in meat products, enhancing their texture and quality. In meat products, carrageenan increases the viscosity and mouthfeel of the meat, preventing the separation of meat and water. Aside from these four sectors, carrageenan is widely used in various other food products such as candy, seasonings, and canned goods. It can be said that carrageenan is a highly versatile food additive that will play an increasingly important role in future food processing. In the future, the trend of using carrageenan will continue to grow. Firstly, consumers' demand for natural food additives will continue to increase. Carrageenan is a natural polysaccharide compound that is more in line with consumers' demand for natural and healthy products compared to synthetic chemicals. Secondly, as technology continues to develop, the manufacturing process of carrageenan will be improved, further enhancing its quality and functionality. Finally, the flexibility of carrageenan in its applications will also be increased, enabling it to be used in more fields. However, it should be noted that as the use of carrageenan expands, its safety issues also need to be sufficiently addressed. Therefore, in future applications, it is necessary to strengthen the safety assessment and regulation of carrageenan to ensure its impact on human health is controllable. In summary, carrageenan, as a natural food additive, will play an increasingly important role in future applications. At the same time, attention should be paid to its safety issues to ensure consumers' health and safety.If you are in need of carrageenan products, please contact us at Foodchem. We not only offer various types of carrageenan products for different applications, but also provide technical services and customized packaging design.

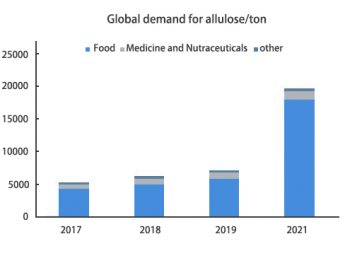

Allulose, a new type of sugar substitute for hypoglycemic Allulose is a well-studied rare sugar that has been granted GRAS certification by the US FDA, meaning it is generally recognized as safe as a food ingredient under the conditions of intended use in food and beverages. However, allulose has not been listed in China for the time being. Allulose is an isomer of fructose, a monosaccharide with very low content in nature. It is found in natural foods such as fruits, raisins, figs and kiwi. White powder, easily soluble in water. ⭕ Allulose Features ✅Low calorie. Calories are much lower than sucrose, about one-tenth of sucrose, and a small amount of calorie is approximately 0 ✅The taste is close to that of sucrose. The sweetness of allulose is 70% of that of sucrose, which is very similar to high-purity sucrose. It stimulates the taste buds slightly faster than sucrose. There is no bad taste during consumption, and changes in temperature will not affect its sweetness. High-sweet stevia will feel greasy, and allulose is better at this point. ✅ Maillard reaction. Allulose can undergo the Maillard reaction and can replace sucrose in baking. ✅High security. Allulose has passed the GRAS safety certification of the US FDA, and is considered by European and American scholars to be the best substitute for erythritol. Humans generally have a certain tolerance to the intake of sugar alcohols. If the tolerance is exceeded, symptoms such as diarrhea may occur, but allulose will not occur, and it is very safe. ✅Control blood sugar and suppress blood sugar response. Allulose has no effect on blood sugar and suppresses the glycemic response of other carbohydrates when tested with carbohydrates ✅Anti-obesity. Studies have shown that allulose has the potential to pre-obesity in animal models. It suppresses the expression of genes related to fatty acid synthesis and increases the expression of genes related to lipolysis. Comparison of Allulose with Other Sweeteners sweetener Year of listing Relative sucrose sweetness taste safety usage limit steviol glycosides 2008 200 times Mint flavor high certain restrictions Mogroside 2012 250-300 times Monk fruit flavor high not limited Glycyrrhizin 80-300 times Slightly bitter aftertaste higher not limited Xylitol 1999 1.2 times coolness high not limited Erythritol 2002 0.6-0.7 times pure high not limited Maltitol 1964 1 times soft high not limited Sorbitol 0.5-0.7 times coolness high not limited Arabic candy 2003 0.5 times pure high not limited Tagatose 2001 0.92 times pure high not limited Allulose 2012 0.7 times pure high not limited According to data from Future marketing sights, before 2019, the global demand for allulose was around 7,000 tons, and by the end of 2021, the global allulose market will reach US$210 million, corresponding to a demand of about 20,000 tons, of which 55% For food, 37% is used for beverages, and a small amount is used for medicine. In October 2021, my country's National Health Commission has accepted the application of D-psicose as a new food raw material. In view of the long-term research on the safety of psicose abroad and the approval of its application in more countries and regions, my country's Food-grade applications of allulose are also expected to be approved. We believe that with the approval of allulose by the state and the improvement of relevant laws and regulations in China, the demand for allulose is expected to rise to a higher level. Data source: China National Financial Securities Research Institute

Bangladesh has mandated the payment of tariffs, fees and charges of any kind related to import and export trade through the Chittagong Customs (CHC) electronic payment method. CHC stated in a notice that from January 1, 2022, it will no longer accept manual payments. It also stated that importers and exporters will be responsible for the delay in the delivery of goods caused by the failure to make electronic payments. Starting from July 1, Chittagong has made it mandatory to use electronic payments when the value of payments exceeds US$2,500, in order to provide faster services to Chittagong users. Mainly clearing and transshipment (C&F) agents make such payments on behalf of importers and exporters. The electronic payment system is also designed to help prevent tax evasion by port customers. The person in charge of the port stated that the government is trying to provide faster services to Bangladeshi port customers through digital payment and delivery. Therefore, all services are phased into the paperless system. The Chittagong Port Authority (CPA) recently put forward a mandatory requirement to submit delivery orders electronically as part of the digitization of various services. Starting from December 1, six top shipping agents-APL Bangladesh, Maersk Bangladesh, Continental Traders BD Ltd, Continental Traders, Ocean International Ltd and Mediterranean Shipping Bangladesh Co., Ltd., have been required to submit delivery orders online. The remaining freight forwarders will be required to do the same thing in stages. In the absence of an electronic bill of lading system, the representative of the C&F agent will personally go to the shipping agent or freight forwarder’s office to pick up the bill of lading in order to pick up the imported goods. According to the RCEP policy, South Korea and Japan established a free trade relationship for the first time The 15-nation free trade agreement that lasted for 8 years will be gradually implemented. First of all, 10 countries including China, Japan, New Zealand, Australia, Singapore, and Vietnam have made it clear that they will start implementation on January 1 next year. The remaining countries are promoting various audits, such as South Korea. According to news from the Ministry of Trade, Industry and Energy of South Korea, the "Regional Comprehensive Economic Partnership Agreement" (RCEP) will officially come into effect for South Korea on February 1 next year after being approved by the South Korean National Assembly and reported to the ASEAN Secretariat. It is reported that the South Korean National Assembly approved the agreement on the 2nd of this month, and then the ASEAN Secretariat reported that the agreement will take effect for South Korea in February next year, 60 days later. As the world's largest free trade agreement, South Korea’s exports to RCEP members account for about half of South Korea’s total exports. After the agreement takes effect, South Korea will establish a bilateral free trade relationship with Japan for the first time. According to South Korea, business transactions with RCEP member states predict that the scale of export trade will be close to 270 billion U.S. dollars, which will account for nearly 50% of the country’s export business. It is reported that thanks to the blessing of RCEP, Japan will establish a bilateral free trade relationship with South Korea for the first time, and more than 80% of the products of the two countries will be "duty-free." However, considering the direct competition between Japan and South Korea in the automobile and machinery industries, South Korea has not released restrictions on these industries. Earlier, South Korea issued a report stating that 20 years after RCEP takes effect, the country’s annual GDP growth rate will increase by 0.14%.

With the rapid development of the low-sugar/sugar-free product market, sugar-free sweeteners, as an important partner in the development of low-sugar/sugar-free products, have also ushered in an unprecedented period of rapid development. Sugar sweeteners are bound to usher in major development opportunities. 1.Policy guidance to promote the development of low-sugar/no-sugar industries In 2016, the World Health Organization released the "Global Diabetes Report". Approximately 422 million people worldwide suffer from diabetes and 318 million people have impaired glucose tolerance. Every year in the world, such a high-level population suffers from the pain caused by diabetes, which has attracted the attention of governments all over the world. The WHO stated that reducing the intake of sugar-sweetened beverages can reduce the risk of obesity, type diabetes, and dental caries, and recommends that adults should not consume more than 50g of added sugar per day, preferably around 25g. In recent years governments of various countries have introduced various regulations and policies (Figure 1) to promote the development of low-sugar/sugar-free markets and guide people’s healthy eating behaviors, hoping to control consumption and reduce consumption of high-sugar beverages by increasing taxes on sugar-sweetened beverages or food. Improve people's physical fitness index. Therefore, global sugar reduction policies will become tighter and tighter, focusing on guiding companies to guide consumers to low-sugar diets and promote human physical and mental health. Foodchem® Marketing Department Drawing 2.Consumer demand promotes the development of low-sugar/no-sugar product categories With the improvement of consumers' health awareness and the increase in the proportion of obesity and diabetes at younger ages, more and more consumers are aware of the unhealthy effects of high-sugar diets, and therefore increasing demand for low-sugar/no-sugar. In 2016, a Euromonitor survey showed that 47% of consumers around the world tend to choose low-sugar or sugar-free foods, and the global consumer demand for sugary sweet snacks has declined. Even though the public generally believes that the healthy pure fruit juice market is showing a downward trend due to higher sugar content, researchers have begun to focus on how to reduce the sugar content in fruit juices, and then develop low-sugar fruit juice drinks. At present, low-sugar and sugar-free products in mainstream foods and beverages in the market are still rare, far from satisfying consumers' demands for diversified low-sugar/sugar-free products. The global market for all sweeteners and sweetening ingredients is expected to reach US$110 billion in 2020. However, the current high-power sweetener market is only about US$2.5 billion, accounting for only 2.27% of the sweetness market (data from China Food News). Therefore, based on the strong combination of policy guidance and consumer demand, food operators will comprehensively carry out the development and research of low-sugar/no-sugar products. High-strength sweeteners have the advantages of low cost and high sweetness, and they are bound to become indispensable for the majority of food operators. s Choice. 3.The upgrade of sugar substitute sweeteners promotes the growth of sucralose market demand Consumers' consumption needs and concepts are constantly upgrading, especially the consumption of imported products is more rational, no longer simply pursuing the pleasure of taste, paying more attention to product brands and product ingredients to ensure product quality, safety, and health demands are becoming stronger. Sugar-free high-strength sweeteners started from the first generation of saccharin, and have been developed many times by cyclamate, aspartame, acesulfame K, sucralose, etc. Sucralose is currently considered to be a superior sugar substitute product, and it is safe Sex, stability, and taste are widely recognized, and it is an ideal sweet substitute for foods for obesity, cardiovascular disease and diabetes patients. 4.New market demand drives the growth of sucralose market capacity Sucralose has not only won the recognition of enterprises and consumers in the food and beverage market. With the continuous improvement of the quality of life, the fields of daily chemicals, health care products and medicine are constantly exploring and innovating, creating more high-quality products to meet contemporary consumption. The pursuit of quality life. In the early days, saccharin sodium was commonly used in toothpaste products for flavor correction, but currently, children’s toothpaste basically uses sucralose instead of the original saccharin sodium products. Sucralose has also become synonymous with high-end quality in toothpaste, and will gradually be used in toothpaste in the future. Popularized in the market, the market demand for sucralose will have a substantial growth by then. The pharmaceutical industry is an emerging market area for sucralose products, and white sugar is often used as a flavoring agent in this area. Due to the taste problem of medicines, the amount of sugar added is usually high. Diabetes and obese people are completely unsuitable for such sugar-containing preparations. Therefore, there is an urgent need to support various low-sugar/no-sugar pharmaceutical products to meet patients and low-sugar/no-sugar medicines. Consumer demand. The development of sucralose in the pharmaceutical market has just begun, and the development of new markets will further promote the expansion of sucralose market capacity. 5.The impact of sucralose globalization At present, more than 120 countries and regions around the world have approved sucralose for use in food, health care products, medical and daily chemical products. The FAO/WHO Joint Expert Committee on Food Additives (JECFA) has identified sucralose as a Grade A food additive "Generally Recognized as Safe (GRAS)". According to the conclusion of the European Food Safety Agency (EFSA), sucralose sweetener is safe and can be used in special medical foods for children. Internationally, sucralose has long been recognized by many multinational international companies and has become a high-quality raw material supplier for these giants, including Coca-Cola, Pepsi, Danone, Mondelez, Procter & Gamble, Unilever, Bayer, etc. In China, some large companies have adopted sucralose as a priority for product research and development or to replace the original sugar source. Therefore, sucralose will further develop in the global market. 6.Forecast of sucralose market size Based on the above analysis, our research center predicts that the sucralose market will continue to maintain a long-term stable growth at an annual growth rate of about 10%-20% in the next five years. Analysis of sucralose market demand from 2021-2025 2021 2022 2023 2024 2025 Global Demand (tons) 16,000 20,000 22,500 25,000 27,000 High-strength sweeteners are a food additive field that has been studied by scientists from all over the world. It has a wide range of applications and involves many fields. Sweeteners play an important role in the flavor of food and beverages. The use of sweeteners in food not only satisfies consumers The sensory demands for sweetness, taste and flavor are also the demands of many food production processes. In recent decades, sweeteners or high-strength sweeteners have also attracted wide attention from consumers due to their advantages such as high sweetness, low calories, and resistance to dental caries. The development of sugar-free and low-sugar foods and beverages worldwide is fast, and people's food consumption is generally inseparable from sweeteners. The partial or complete replacement of sugar intake by sweeteners is a trend that is currently taking place globally. Nowadays, the application of sweeteners in the food industry is becoming more and more extensive. With the development of the world food industry and the health food industry, the development and application of more safe and efficient new sweeteners is also a trend. At present, global hypoglycemia is imminent, and it is inseparable from the use of sugar-free sweeteners. Sucralose, as a popular sugar-free high-strength sweetener on the market, will have greater room for growth and a better future for development.

The excessive consumption of sugar has caused widespread concern. In September 2021, Academician Chen Junshi pointed out at the "First China Drinks Healthy Consumption Forum" that replacing sugar with sweeteners is the development trend of the beverage industry. So, what are the current sugar replacement programs? Which sweetener is more promising? Chen Junshi - Member of China Engineering Academy General Counsel, National Center for Food Safety Risk Assessment Low sugar, sugar replacement trend Sugar is one of the most popular ingredients in the diet. Consumers are accustomed to the sweetness and texture, and enjoy the comfort and happiness from it. However, it is surprising that most sugar consumption comes from deep-processed foods and sugar-sweetened beverages, rather than desserts and candies. At present, global consumers' attitudes towards sugar have changed: processed sugar is considered unhealthy, which has led to an increase in obesity rates around the world, while less refined sugar is considered clean and natural. Global concerns about excessive sugar consumption and the increase in diseases have led to an increase in demand for low-sugar and low-sugar products. This situation has forced food and beverage formulators to put sugar reduction in the first place in product innovation, development, and marketing strategies. Similarly, sweetener manufacturers are also more in-depth research and development of sweeteners to replace sugar to cater to this highly active market demand. Source: Innova Market Insight, ChemBizR Analysis Classification and key characteristics of sweeteners The global sugar and sweetener market share are approximately US$25 billion (approximately RMB 161.1 billion), and this market has undergone tremendous changes in the past decade. More research and development are underway, including low-sugar, low-calorie sugar, high-sweetness sugar, artificial sugar, processed sugar, and natural sugar selection. Generally speaking, sweeteners can be divided into the following six categories: (1) Sugars: carbohydrates are naturally present in many foods, including fruits, vegetables, grains, and milk. The most common are sucrose, glucose, fructose, lactose, maltose, galactose and trehalose. (2) Sugar Alcohols: A type of carbohydrates naturally found in plants and grains, albeit in small quantities. The human body cannot completely metabolize them, so they tend to have fewer calories per gram of weight. The most common are sorbitol, xylitol, mannitol, maltitol, erythritol, isomalt, lactitol, and glycerin. (3) Natural Caloric Sweeteners: The oldest known sweeteners, including honey and maple syrup. They not only contain sugar, but also other nutrients. Their glycemic index is often lower than sugar. The most common ones are honey, maple syrup, coconut palm sugar, and sorghum syrup. (4) Natural Zero-Calorie Sweeteners: They are not carbohydrates, they only contain few or no calories. In recent years, people's interest in this type of sweetener has increased day by day because they are good substitutes for artificial sweeteners. Their glycemic index is zero and they have an aftertaste. The common ones are stevia, allulose, mogroside, and brazzein. (5) Modified Sugars: These sugars are usually produced by enzymatic conversion of starch, including modified sugars such as caramel or golden syrup. They are often used in cooking or processed foods. The most common are high fructose corn syrup, caramel, agave syrup, inverted sugar, and golden syrup. (6) Artificial Sweeteners: Artificial sweeteners are usually called "high-intensity sweeteners" because their taste is similar to sugar, but their sweetness is as high as several thousand times. There are many types on the market, and some seem to be safer than others. They have been used in the United States and Europe for more than 120 years. The most common ones are aspartame, sucralose, saccharin, neotame, acesulfame K and cyclamate. The key characteristics of sugar and sweeteners include sweetness (relative to sucrose), calorific value (calories per gram), taste, texture, volume, color (browning) and probiotic functions. Sugars, modified sugars and sugar alcohols are usually products with lower sweetness and standard calorific value (2~4 cal/g), while artificial sweeteners are products with higher sweetness and usually no calories. Most of the research and development centered on sweeteners with high sweetness and low calories. Clean, pure and natural has become the driving force for the development of these sugars. However, price is still the biggest driving force for development and innovation in the sweetener and sugar fields. Source: Innova Market Insight, ChemBizR Analysis The challenge and the key to development Since 2018, the market for high-intensity sweeteners has begun to grow, with a year-on-year growth of 12% in 2019. Although people are worried about the metallic odor and slightly bitter aftertaste brought by high-intensity sweeteners, high-intensity sweeteners are used in all major food categories, such as nutrition, baking, beverages, and candy. Sweetener suppliers are under great pressure to provide the right solutions. Many suppliers have introduced new solutions that combine high-intensity sweeteners, rare sweeteners and low-intensity sweeteners. Multinational companies are helping their customers experiment with different product formulations through digital platforms to find the right taste and texture. New product development is the key to the sweetener business. Most of the research and development of sweeteners are focused on sweetness, calorific value, taste, odor resolution, key functions and price competitiveness. Before expanding into commercial production, new products, application development, functional features (such as probiotic functions), feasibility, and product price models need to be tested. Generally speaking, it takes 12 to 18 months for a company to develop any new process or new product containing new ingredients. In addition, for a new sweetener product, large-scale commercialization is relatively slow, because the market now has many options and alternatives. With the development of the food industry in the direction of low-calorie, low-sugar, high-fiber, natural, organic, clean and healthy, more and more manufacturers are replacing sugar with sweeteners and natural substitutes without compromising taste. . Sweetener manufacturers are also studying rare sugars, such as fucose, kojibiose, cellobiose, brown sugar, etc., but these are still in the research stage, and the main challenges they face are product feasibility and formulation requirements. Sweetener manufacturers are facing severe pressure to develop new products and need to provide correct solutions for formula makers around requirements such as taste, texture, cleanliness, and price. The natural sweeteners, allulose and stevia, are still untapped areas for many manufacturers, with promising prospects in the next five years.

In 2019, the global caffeine market was valued at US$14.88 billion according to the Caffeine Market report published by global market intelligence company Coherent Market Insight. Now, it is expected to exceed more than US$23.22 billion by 2027, showing a compound annual growth rate of 7.4 per cent across the forecast period of 2020 to 2027. Global Caffeine Market compound annual growth rate of 7.4 per cent across the forecast period of 2020 to 2027 Making up a large source of caffeine ingredients is coffee. An increasing consumption of coffee globally is predicted to drive market growth over this forecasted period. Coffee consumption has increased across South and East Asia, with this emerging market expected to drive demand for caffeine. Busy lifestyles and longer working hours in most Asia Pacific countries including China and India have also contributed to an increased consumption of caffeine to drive away drowsiness and fatigue. In line with rising demand for organic foods, key players in the market are launching new caffeinated products. One example includes caffeinated water manufacturer Gojai, who launched a new organic caffeinated sparkling water into the market in 2020. The report found that the caffeine market in the European region is expected to grow significantly during the forecast period, mostly due to a rise in energy drinks from key market players. The Latin America caffeine market is also expected to grow at fast rate due to an increase in caffeine consumption. Guarana, as a caffeine source, is predicted to grow at an exponential rate from 2020 to 2027. Guarana contains between 3.6 to 5.8 per cent caffeine by weight, with an ability to enhance athletic and mental performance, alongside increasing energy and reducing obesity. Food and beverage manufacturers are predicted to launch novel products with a focus on natural ingredients, such as Guarana, which will further drive market rate. The report further found that synthetic caffeine is predicted to be consumed more than natural caffeine due to an increased availability of energy and sport drinks in supermarkets and hypermarkets. The beverage sector, based on application, is estimated to dominate the overall caffeine market. The Caffeine Market report found in 2020, global consumption of tea was about 6.3 billion kilograms, which now, is anticipated to reach 7.4 billion kilograms by 2025. Major market players in the global caffeine market include Basf, Spectrum Chemical Manufacturing Corp., Kudos Chemie, AVT Natural Products, Tianjin Zhong’an, Pharmaceutical Company, Shandong Xinhua Pharma, Aarti Industries Limited, Bakul Group, Taj Pharmaceuticals, and Jilin Shulan Synthetic Pharmaceutical Co. Demand for caffeine is expected to rise during and post the COVID-19 pandemic, despite its negative impact on raw material suppliers of caffeine. Lockdowns due to the pandemic saw a halt in the supply chain and in related trading activities.